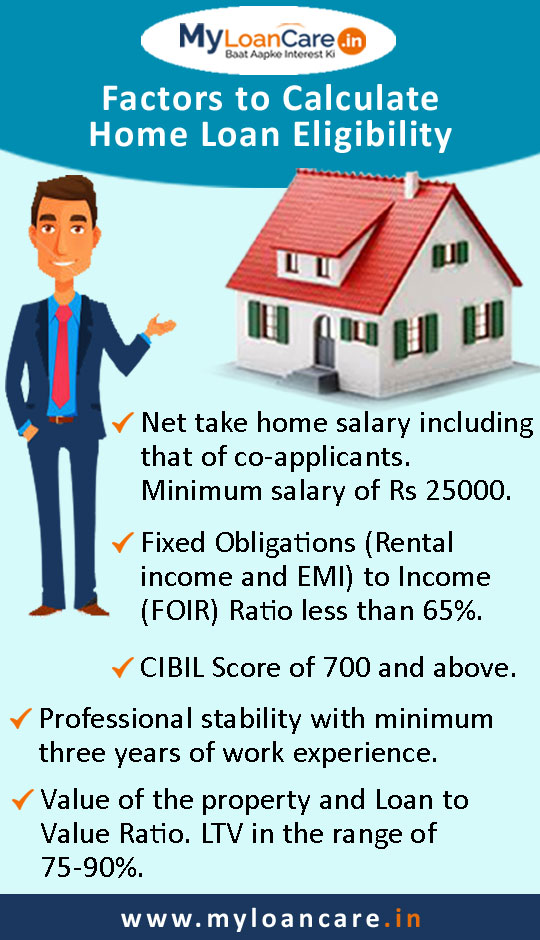

Factors Which Affect your Housing Loan Eligibility

Before applying for a home loan, it is important to determine your home loan eligibility which is dependent on several factors. The first important factor that you need to keep in mind is your age. The early you apply for a home loan, the more is the possibility of a bigger amount getting sanctioned to you by the bank.

Next is your qualification and experience. If your academic credentials and work experience are impressive, the banks may sanction a higher amount of loan. Your qualification and work experience predict stability and progress fairly well. Also, a credit score of 650 and above is considered good for a housing loan.

A lender can use credit score to assess your repayment capacity before approving the loan. Further, having a regular and stable income is a necessity if you want to get your loan approved. This varies according to your profession. Missing EMIs regularly on your existing loans, or making EMI payments after the due date are also a cause of concern for your lender. So, be disciplined with your repayments to get a high loan amount. Lastly, choose the right property that has the potential to increase in value in order to secure substantial funds. So, before applying for a housing loan, keep these important factors in mind to determine your eligibility and to get an easy approval of loans. You can also make use of a home loan eligibility calculator through various online aggregators.

Next is your qualification and experience. If your academic credentials and work experience are impressive, the banks may sanction a higher amount of loan. Your qualification and work experience predict stability and progress fairly well. Also, a credit score of 650 and above is considered good for a housing loan.

A lender can use credit score to assess your repayment capacity before approving the loan. Further, having a regular and stable income is a necessity if you want to get your loan approved. This varies according to your profession. Missing EMIs regularly on your existing loans, or making EMI payments after the due date are also a cause of concern for your lender. So, be disciplined with your repayments to get a high loan amount. Lastly, choose the right property that has the potential to increase in value in order to secure substantial funds. So, before applying for a housing loan, keep these important factors in mind to determine your eligibility and to get an easy approval of loans. You can also make use of a home loan eligibility calculator through various online aggregators.

I think this is among the most vital info for me. And i am glad reading your article. But wanna remark on some general things, The site style is wonderful, the articles is really excellent : D. Good job, cheers. Hard Money Loan

ReplyDelete